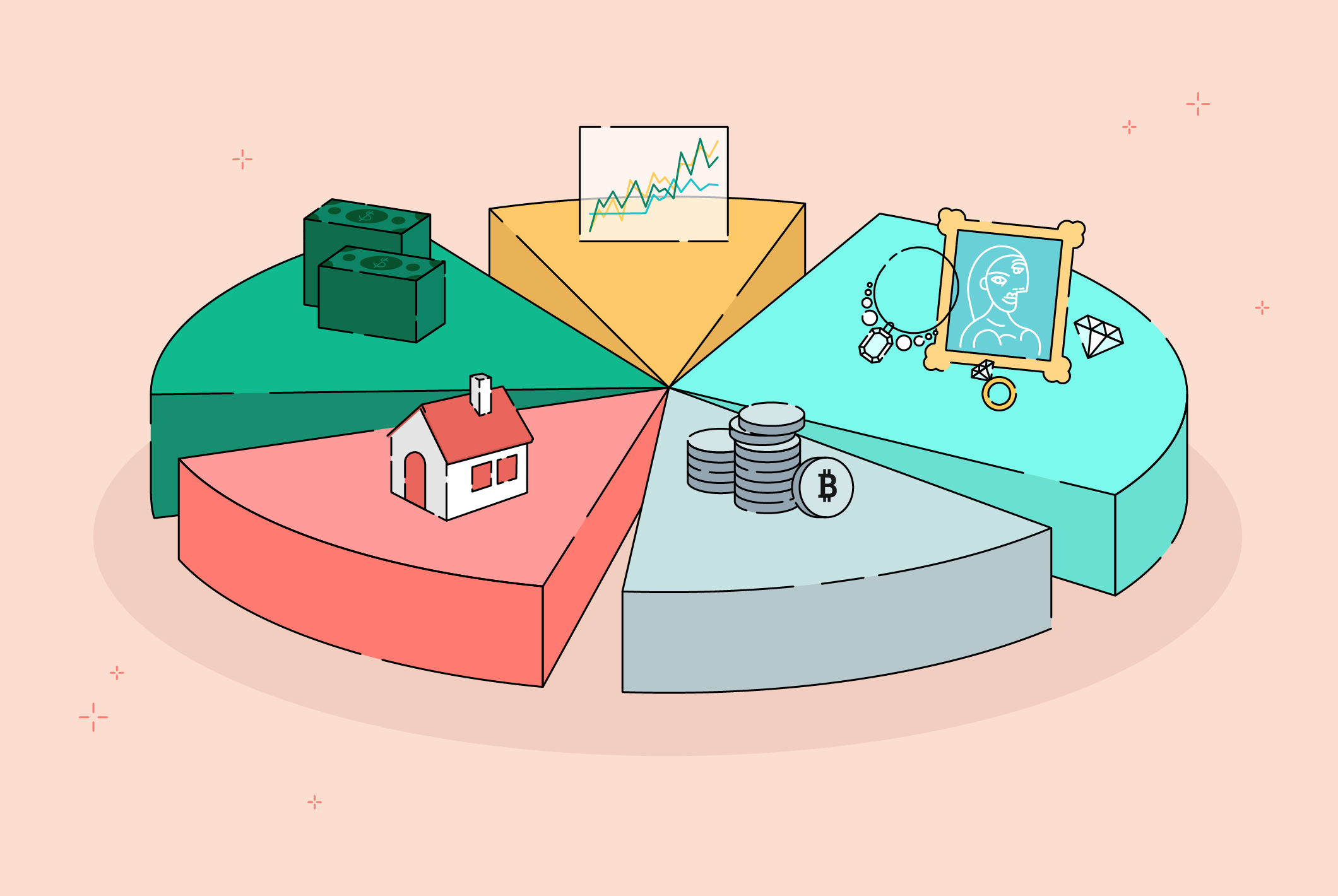

Diversifying your investment portfolio is crucial for a number of reasons. It can help to reduce risk, increase returns, and protect your assets from unforeseen events. Here are five reasons why diversification is so important:

- Reduces risk. The most obvious benefit of diversification is that it can help to reduce risk. When you invest in a variety of assets, you are not putting all of your eggs in one basket. This means that if one asset performs poorly, the others may still perform well, and your overall portfolio will not be as affected.

- Increases returns. Diversification can also help to increase returns. This is because different asset classes tend to perform differently at different times. By investing in a variety of assets, you can take advantage of this cyclicality and improve the overall performance of your portfolio.

- Protects your assets. Diversification can also help to protect your assets from unforeseen events. For example, if there is a recession or a market crash, your portfolio will be less likely to be wiped out if it is diversified.

- Makes it easier to sleep at night. One of the biggest benefits of diversification is that it can give you peace of mind. When you know that your portfolio is diversified, you don’t have to worry about losing everything if one asset performs poorly. This can help you to sleep better at night and focus on other things in your life.

- Is easy to do. Diversification doesn’t have to be complicated. There are many ways to diversify your portfolio, even if you don’t have a lot of money to invest. You can start by investing in a variety of mutual funds or ETFs. These funds are baskets of stocks or bonds that are managed by professional investors. This can help you to diversify your portfolio without having to do a lot of research on individual stocks or bonds.

If you are not sure how to diversify your portfolio, you should talk to a financial advisor. They can help you to create a portfolio that is right for your individual needs and risk tolerance.

Here are some additional tips for diversifying your investment portfolio:

- Invest in different asset classes. Asset classes are broad categories of investments, such as stocks, bonds, and real estate. By investing in a variety of asset classes, you can reduce your risk and increase your chances of achieving your financial goals.

- Invest in different industries. Within each asset class, there are different industries. For example, within the stock market, there are industries such as technology, healthcare, and consumer goods. By investing in companies from different industries, you can further reduce your risk.

- Invest in different countries. The global economy is becoming increasingly interconnected. As a result, it is important to invest in companies from different countries. This can help to reduce your risk and increase your exposure to growth opportunities.

- Rebalance your portfolio regularly. As your investments grow, it is important to rebalance your portfolio. This means selling some of your winners and buying more of your losers. Rebalancing helps to ensure that your portfolio remains diversified and that you are not overweighted in any one asset class.

Diversification is an important part of any investment strategy. By diversifying your portfolio, you can reduce your risk, increase your returns, and protect your assets from unforeseen events.thumb_upthumb_downuploadGoogle itmore_vert